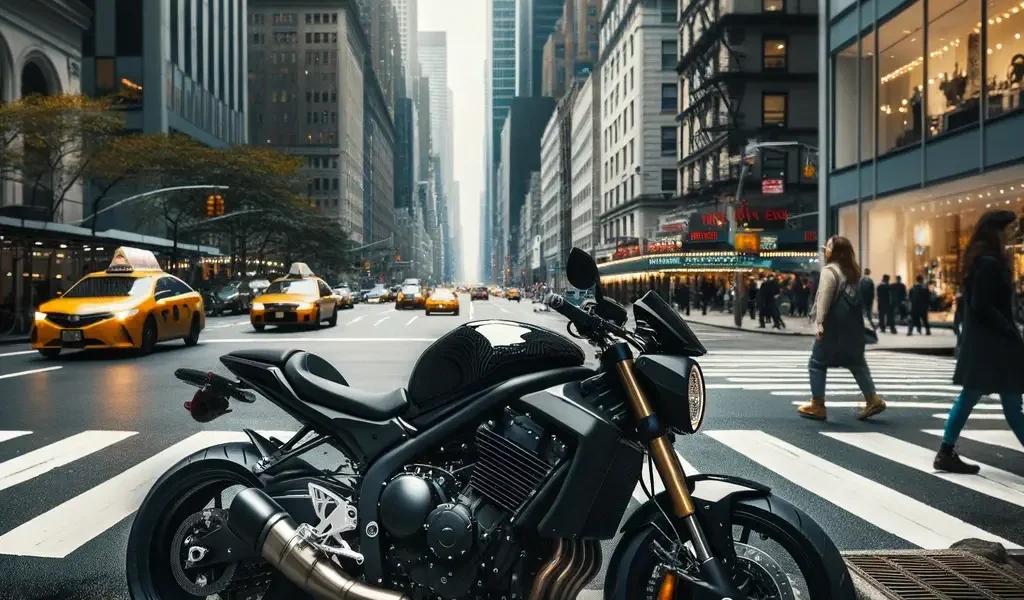

A Business Motorbike: Fuel for Your Business Adventure!

When you think of a company vehicle, often the first thing that comes to mind is a car. But did you know that a company motorbike can be considerably more advantageous? The amount you actually pay as extra tax after the additional tax is usually limited to a few tens to a few hundreds of euros for a motorbike, while for cars it is often several thousands of euros. Let’s dig deeper into why a motorbike could be the ultimate choice for your business trip.

Financial convenience and tax advantages

Like a company car, the cost of a motorbike is tax deductible. This includes leasing costs, motor vehicle tax, BPM, insurance premiums, fuel expenses, maintenance costs and a variety of other related expenses. This deductibility can add significantly to the financial benefits of opting for a company motorbike.

Conditions for company motorbike

To benefit from the tax advantages of a company motorbike, you must be able to prove that you really need this two-wheeler for your business activities. Moreover, you must be able to prove that you travel at least 10% of your kilometres on business, with a solid trip registration as proof. These conditions are essential to benefit from the tax advantages of a company motorbike.

Depreciation and residual value

The process of depreciation for a company motorbike follows a similar path as for a car. However, it is important to assess the residual value of the bike realistically. Here, you can rely on the expertise of the supplier, who is usually good at estimating what your bike will be worth in the future.

Additional tax liability for a company motorbike

Unlike cars, where there is often a flat-rate addition, the addition for a company motorbike is calculated based on actual costs for private use. This can be considerably more favourable for your finances. The calculation is simple: (total private kilometres/total kilometres driven) x cost of the motorbike (excluding any fines). The result? Often a much lower additional taxable benefit compared to a company car.

Saving time and money: the highway to success

Besides the financial benefits, a motorbike also offers practical advantages. In a world where traffic jams are the norm, a motorbike can save you a lot of precious time. With ease, you manoeuvre between stationary cars and reach your destination faster. Parking also becomes a breeze, as you can easily park your motorbike on the pavement for free.

Advantages for entrepreneurs

Entrepreneurs have even more to gain from a company motorbike. The same addition rules apply even if you buy the bike yourself and bear all the costs. You can write off these costs as business expenses, meaning you don’t pay tax on that amount. The addition is often capped at the amount of the actual costs, which in practice is often much lower.

In short, a company motorbike offers numerous benefits, ranging from financial savings to time savings and practical advantages on the road. It is a smart choice for employees and business owners alike, and it can save thousands of euros a year in tax savings. Consider the benefits and give your business trip the adrenaline rush it deserves!